Want more housing market stories from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter.

Between April 25 and September 11, the average 30-year fixed mortgage rate fell from its calendar-year high of 7.52% to a low of 6.11% after some weaker-than-expected jobs reports triggered recession indicators, including the “Sahm Rule.“

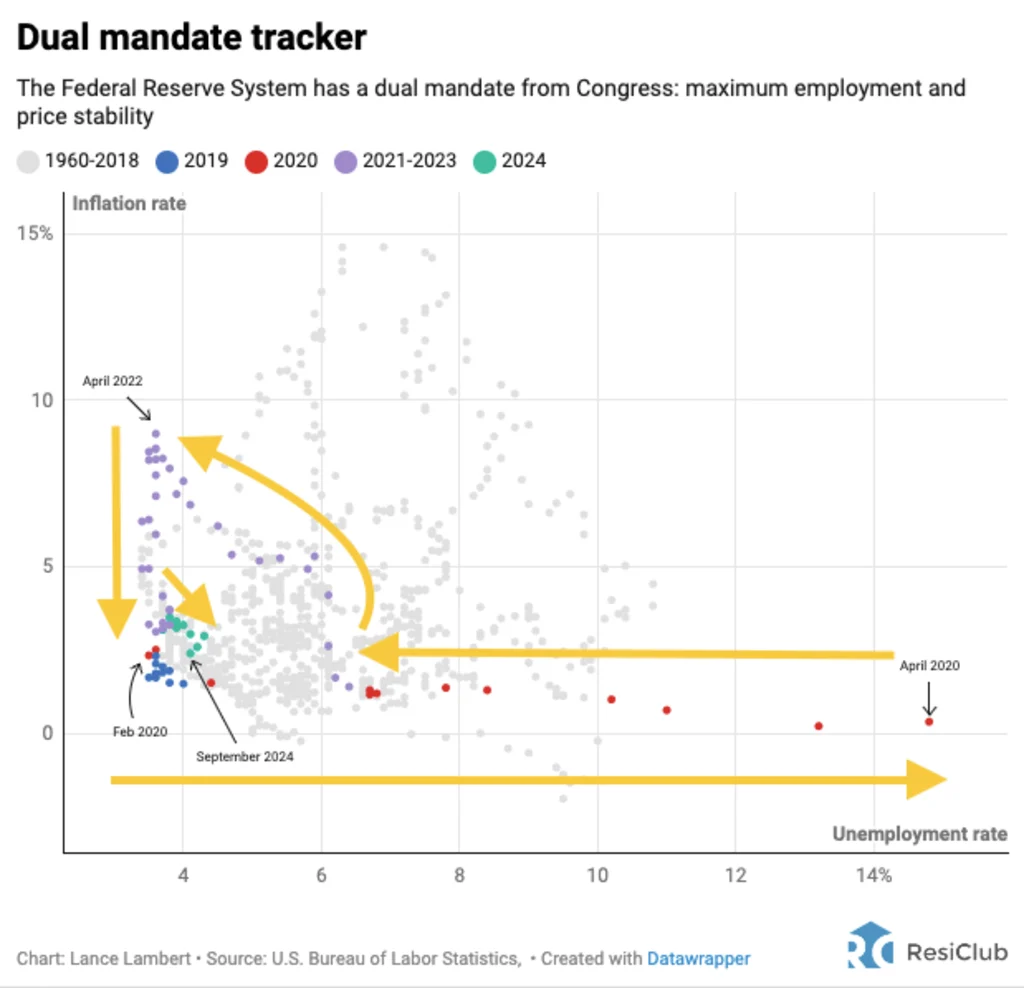

Shortly after, on September 18, the Federal Reserve, citing softer employment data, announced it would cut its short-term interest rate by half a percentage and start the interest rate-cutting cycle.

In the following weeks, most forecasters also lowered their outlook for long-term yields, including mortgage rates for the housing market. Fannie Mae revised its forecast for the average 30-year fixed mortgage rate to 6% for Q4 2024, while Wells Fargo predicted 6.3% for the same period.

But today the average 30-year fixed mortgage rate, as tracked by Mortgage News Daily, is back up to 7%. What’s going on?

The Federal Reserve doesn’t directly set long-term rates like mortgage rates. Instead, financial markets look to expectations about the future direction of the economy, labor market, inflation, and Fed policy.

After rising from a cycle low of 3.4% in April 2023 to 4.3% in July 2024, the U.S. unemployment rate fell back to 4.1% in September, easing near-term recession fears and drawing away some bond buyers who had been purchasing treasuries and mortgage-backed securities as “recession insurance.”

In a scenario where the unemployment rate begins to rise again and economic data softens quickly, we will likely see a greater drop in mortgage rates. Conversely, if the unemployment rate remains low and inflation stays above the Fed’s 2.0% target, mortgage rates could stay higher for longer.

Another factor at play is that financial markets are trying to predict where fiscal policy will head in 2025.

Currently, we have a divided government, with the Democratic Party controlling the White House and the Senate, while Republicans control the House. If one party were to achieve a full sweep, it could create an environment where fiscal spending or deficits rise, depending on their approach—especially if Donald Trump or Kamala Harris were to pursue some of their more inflationary policy proposals.

In the view of financial markets, higher deficits can put upward pressure on mortgage rates and long-term yields. When the government increases its borrowing to cover deficits, it raises the supply of bonds, which can drive up yields as investors demand higher returns for holding more government debt. Additionally, higher deficits may lead to inflation concerns, prompting investors to expect higher interest rates in the future, which also pushes up yields on long-term bonds and mortgage rates.

As election results become clearer next week, keep an eye on the 10-year Treasury yield (which tends to move directionally with mortgage rates). That could paint a picture of how financial markets are interpreting the election results and their implications for fiscal policy.